It looks like Deutsche Telekom's (DTEGY) loss is Finoa's gain.

Six months after leaving the European telecom giant, Andreas Dittrich and Daniel Schrader - two former Deutsche Telekom blockchain employees - have helped create a division at cryptocurrency custody provider Finoa to build infrastructure to support proof-of-stake (PoS) networks.

Finoa, which is regulated by Germany's BaFin, will work with PoS specialist StakeWise, the companies announced Monday. The new subsidiary, Finoa Consensus Services, will offer liquid wagering services.

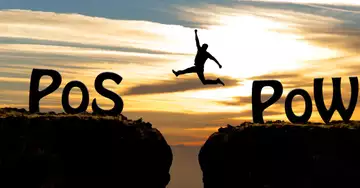

As Ethereum, the second-largest public blockchain, transitions from proof-of-work (PoW) mining to PoS, participants operating transaction validation nodes will need to lock Ether (ETH) tokens on the network for which stake revenue can be earned over time. Liquid Staking platforms offer participants a way to have their cake and eat it too. They provide users with IOU tokens representing assets that are tied to a network for staking and validation purposes, allowing these liquid tokens to be used in decentralized financial protocols (DeFi), for example.

Finoa has been offering in-custody staking for several years. It will operate validators on the Ethereum network and become a StakeWise operator for both Gnosis and Ethereum, explained Dittrich, managing director of the new division.

"In our opinion, Liquid Staking will be on every single PoS network out there within a year or two," Dittrich said in an interview. "Right now it may be new, but in the future it will be widespread and quite normal. You can't do it without liquid staking."

There's a well-trodden path leading innovators away from bureaucratic companies to nimble startups, a steady stream flowing from banks and blue-chip companies to crypto-based firms.

"It's been great working for Deutsche Telekom, with this incredible power behind them and the ability to steer them now and then," Dittrich said. "But really, the speed at which you can move things in a company like Finoa is tremendous, and it's completely crypto. Something that was always pretty exhausting at Deutsche Telekom was convincing people, 'do we want to do this blockchain thing?'"

Still, the recent collapse of stablecoin Terra UST and its associated LUNA could influence regulators' and the public's perceptions of complex mechanisms for generating revenue from next-generation blockchains.

"We expect regulation to come in this area. Maybe the pure infrastructure part of staking will remain like a technical or IT service. But when it comes to liquid staking, it's pretty close to becoming a financial service. We need to be ready for our institutional clients who want to actively support proof-of-stake networks but also do more with their assets. So we're preparing the crypto space for future regulation."