Where did the $3.5 billion go?

Unless you've been off the grid for the past few weeks, you probably already know that the $3.5 billion in Bitcoin was created in part to defend and prop up the TerraUSD (UST) stablecoin, which turned out to be anything but. While it is clear that untold billions in value and wealth were lost when those reserves proved insufficient to prevent depegging, what no one knows is what happened to those reserves and where they are now.

Terra Labs CEO Do Kwon shared via Twitter that documentation on how the reserves were used during the depegging event will be released soon. According to Tom Robinson, co-founder and chief scientist of Elliptic, a blockchain analytics firm, where bitcoin is located and how it was used is critical for investors seeking to recoup their losses suffered as a result of UST.

While it's uncertain when Terra will release that documentation, Robinson said his company has been tracking the money: about $80,394 BTC worth $3.5 billion when it was purchased between January and May of this year by Luna Foundation Guard, the nonprofit created to help grow the Terra ecosystem.

When the value of UST began to fall early last week, LFG announced that it would divest its bitcoin reserves and buy UST. On the morning of May 9, LFG announced that it would "lend $750 million worth of BTC to OTC trading firms to protect the UST peg." Terra founder Do Kwon later clarified that bitcoin would be "used for trading."

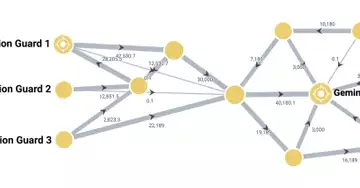

Around the same time, 22,189 BTC (worth ~$750 million at the time) were sent from an LFG-affiliated bitcoin address to a new address, Elliptic explained in a blog post. Later that evening, another 30,000 BTC (worth ~$930 million) were sent from other LFG wallets to the same address.

Within a few hours, the entirety of those 52,189 BTC were transferred to a single account at U.S. crypto exchange Gemini via multiple bitcoin transactions, Elliptic said.

The purpose of a very large bitcoin reserve may have been to buy UST to drive the price back toward $1, which is likely why it was sent to exchanges, but it is not possible to identify with the blockchain alone whether it was sold to support the UST price, Elliptic's Robinson said.

That left 28,205 BTC in Terra's reserves. At 1 a.m. UTC on May 10, those remaining reserves were transferred in full to an account on cryptocurrency exchange Binance in a single transaction. Again, it is not possible to determine whether these assets were sold or subsequently moved to other wallets, Robinson said.

"All we can see is that it's going into these exchanges," Robinson told CoinDesk. "We can't really see how it was used. It could have been sold, it could have been stored on the exchanges, it could have been withdrawn again, and it could be a non-hosted wallet."