For Metaverse real estate investors, the fact that online real estate is worth more than real estate in the real world isn't too hard to imagine, said Armando Aguilar, a digital asset strategist who made the decision to cash out some of his crypto holdings to buy a physical home in October 2019 and later purchased a property in The Sandbox, an online platform, in spring 2021.

"My Metaverse backyard appreciates more than my real estate," Aguilar said. "Real estate prices in the Metaverse are crazy." Since his two purchases, the price of his three-bedroom, two-bath home outside New York City has increased two and a half times, while his Sandbox property has increased 1,400 times its original value.

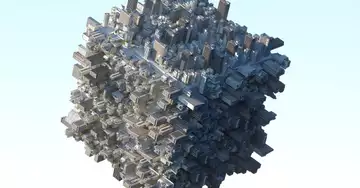

What is virtual real estate, anyway?

If the term "virtual land" is new to you, you're not alone. While a quick glance at crypto Twitter makes it seem like every major company, brand, and celebrity is buying virtual real estate, the reality is that relatively few people are participating in the land rush of the metaverse.

But with the increasing popularity of non-fungible tokens (NFTs), the concept of metaverse real estate doesn't seem so far-fetched. In a recent "New Rules of Business" podcast produced by professional membership network Chief, Janine Yorio, CEO of Republic Realm, a Metaverse investment platform, explained exactly what Metaverse real estate investing is for those who haven't yet taken the plunge:

"Metaverse real estate is an NFT," Yorio said on the podcast. "They are a JPEG or a [digital file that] points to a specific file that is logged on the blockchain, which is this ledger that tracks who owns [each asset]. Just like when you buy a piece of property in a city, you go to city hall and open a drawer to find the deed. Instead, you look at the blockchain."

On a blockchain, you can look into people's wallets, Yorio explained. Every transaction in the cryptocurrency world is also a receipt or a deed, unlike in the real world where the two are separate.

"In the real world, you usually own something, but then there's paperwork to prove it. In cryptocurrency, ownership is part of the transaction. And once it's in your wallet, your ownership is indisputable," Yorio said.

And that indisputable ownership is appealing. Prices for digital property in metaverse worlds like The Sandbox and Decentraland have risen 700% in the last year, and rapper Snoop Dog has built an interactive metaverse (the "Snoopverse") where you can pay as much for your virtual neighborhood as you would for a real house.

But does location matter as much in the metaverse as it does in real life? Yorio argues that it doesn't, when you can just click wherever you want. Property values can fluctuate based on factors we've already become accustomed to - proximity to desirable locations, prestige, digital appeal - as well as new dimensional constraints and advantages. If they seem entirely new and invented, it's because they are.

"Locating a great brand or project adds value to the land that surrounds it," says Sam Huber, founder and CEO of metaverse advertising agency Admix. That's a thought we can get on board with.

Does location matter in the metaverse?

In a digital world where one click can take you from one particular area in the metaverse to another, developers are also getting creative when it comes to designing the new frontiers and possibilities of virtual worlds.

"Different platforms solve the problem in different ways," Huber says. "On the one hand, there are platforms where distances don't matter at all, as is currently the case with Sandbox, because all you have to do is basically click into the area you want to go to and go directly there.

The problem with that, Huber said, is that it becomes more difficult to determine the value that depends on proximity to Snoop's house.

"If distance is not a problem, there really shouldn't be areas that are much more expensive than others because you can always get anywhere, even if it's on the edge of the map," Huber says.

In the virtual world Somnium Space, for example, there is a teleporter for this reason - but at a price.

"It's the token that they have," Huber explains. "So you can 'go' [where you want to go] for free, or you can skip the 'walk' by taking a teleporter, which is also sold as an NFT." Some people own the teleporter and can charge for its use - a nice little perk.

The idea of a teleporter NFT may seem a little outlandish, but that's the fun of the sandbox or a metaverse. Architects, developers, programmers, gamers, designers - and basically pretty much everyone who loves Web 3 - enjoys building in these new, digital realms because the boundaries of reality can be set as we define them.

"We don't want to replicate the barriers of the physical world, like distance and gravity, in the digital world. We build [in the Metaverse] to avoid that in the first place," Huber says. "Some people may see it as added value to be able to teleport," he says, while others see it as an "artificial scarcity" created just to share in the cash cow of the metaverse.

But the artificial scarcity of the metaverse doesn't seem to be stopping people from joining in the fun. The Reddit community for the Ethereum-based Decentraland metaverse has more than 85,000 members discussing topics such as luxury brands participating in Metaverse Fashion Week, opening storefronts to sell digital goods, the price of MANA - the digital currency used in the Decentraland metaverse - and more.

How to invest in Metaverse real estate.

If you feel ready to take the plunge and invest in metaverse real estate, there are a few practical steps you can follow:

Choose a metaverse to buy and know why

According to Yorio, who wrote a guide on metaverse real estate investing earlier this year, there are two different ways to determine the likely value of your metaverse property and thus decide which metaverse platform you should choose.

First, there is what she calls "Asset-Based Valuation," which looks at Metaverse economics in much the same way we do with physical real estate. For this model, you have to research how much metaverse real estate is selling for in different NFT marketplaces and understand what makes real estate valuable in each metaverse.

For example, casinos drive up property values in Decentraland, Yorio explains, while a property near Snoop's house in the Sandbox has a higher price. You can also consider factors such as lot size, development regulations (e.g., how tall buildings can be), and the overall scarcity of the Metaverse (when fewer lots are available, prices are higher).

Popular Metaverse platforms such as Decentraland, The Sandbox, Axie Infinity, Crypto Voxels, Somnium Space, and EmberSword, among others, have published the total number of plots they plan to make available to buyers. This helps with a simple supply and demand assessment of each metaverse, but there is more to consider for a deeper analysis.

A second way to look at value, therefore, is from the perspective of a venture capitalist. In this strategy, it's more important to focus on metrics such as the number of monthly users interacting in a particular metaverse, the types of companies building projects there, and the type of return you can get by investing your money in the early stages of a project that could be the next virtual meeting place or virtual gaming community. According to Yorio, there are three main indicators of whether a project is worth buzz:

- Traction

- Team

- Roadmap

How many people are talking about the future metaverse in the Discord messaging app, what teams are building and promoting the projects there, and how solid are the plans to make these ambitious ideas a reality?

Yorio points to a few examples that have achieved considerable success from a venture capitalist's perspective. Star Atlas, for example, a metaverse that makes acquiring virtual real estate "fun," describes its unique marketing plans on its website. Community-building strategies include NFT posters, collaborations with music artists, and tiered rewards that encourage people to participate.

Other projects, like Ethereum-based immersive platform Wilder World, work with influencers to create a similar hype effect. When investing in such areas, it's wise to think like a venture capitalist and decide for yourself whether a project's roadmap is viable.

Be prepared for the costs

Whether you buy Metaverse land on the platform's marketplace or on an NFT marketplace like OpenSea or Non-fungible.com, there will likely be processing fees ranging from 0% to 5%, along with fluctuating gas fees for Ethereum-based projects.

If you're buying land in a metaverse that uses a type of cryptocurrency you don't own, such as MANA from Decentraland, you should also be prepared to pay the normal transaction fees required to buy that new currency on an exchange like Coinbase, in addition to any capital gains or losses you may incur when exchanging one currency for another.

As for the actual price of the plots themselves, the cost varies depending on the economics of each metaverse. For example, a small parcel of land in Somnium Space costs 2.1167 ETH (about $6,362) on OpenSea at the time of writing in March 2022. That would entitle the buyer to 2,153 square feet of virtual land with a maximum building height of 33 feet. The most expensive lot in Decentraland recently sold for more than $2.4 million.

View the price history

Thanks to the blockchain's transparent transaction history, you can make an informed decision when buying Metaverse real estate without having to call in a real estate agent (although, yes - Metaverse real estate agents are proliferating).

Third-party platforms like OpenSea will most likely show purchase history for any property you're considering. Look at the price history so you can get an idea of how much the price has already gone up or down since you listed it.

Weigh the pros and cons.

Just like buying land, you should consider the logistical aspects of buying a building lot: you'll need to buy more NFT materials and tools, and you may need to hire developers to help you realize your vision - or you may simply buy the lot for its future resale value.

You can also buy land where structures such as a house or billboard have already been built, or turn multiple parcels into lots by connecting them, which adds even more value.

According to Yorio, large contiguous lots are more valuable. One strategy, therefore, may be to buy cheaper plots of land in order to link them together - but, of course, this depends on the right timing.

It's clear that inexperienced investors (and yes, everyone in the Metaverse is basically a beginner because it's so new) have made a lot of money with initial investments of less than $10,000. However, as with any crypto strategy, it's best to start with smaller amounts that you can afford to lose, at least until you understand the market enough to make more targeted predictions about which metaverses will make it and which will disappear into the ether forever.