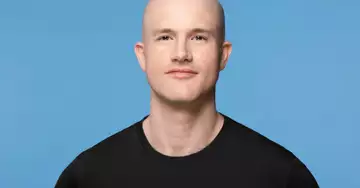

Coinbase founder and CEO Brian Armstrong said in a tweet Wednesday that the new wording in the latest 10-Q filing is simply a new requirement from the U.S. Securities and Exchange Commission and that Coinbase is not in danger of going bankrupt.

- Armstrong said the exchange had included "a new risk factor based on an SEC requirement called SAB 121, which is a newly mandated disclosure for public companies that hold crypto assets for third parties."

- The 10-Q, filed with the SEC on Tuesday, states, "Because crypto assets in custody may be considered property of a bankruptcy estate, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings in the event of a bankruptcy and those customers could be treated as our general unsecured creditors," Coinbase wrote in its latest filing.

- Coinbase also shared that this means customers may believe that keeping their coins on the platform would be considered "riskier," which in turn would significantly impact the company's financial position.

- In the event of bankruptcy, a general unsecured creditor would be considered to have the most to lose, as they would be last in the queue for claims.

- "We believe our prime and custody customers have strong legal protections in their terms and conditions that protect their assets even in the event of a black swan like this," Armstrong wrote in his tweet. "This disclosure makes sense in that this legal protection has not been tested in court specifically for crypto assets."

- Caitlin Long, founder and CEO of digital asset bank Custodia Bank (formerly known as Avanti) said in a tweet that this is not new and is an inherent problem with the regulatory structure used by most custodians.

- "Wyoming has solved this problem by creating a new customer-friendly structure designed to respect the segregation of customer assets in bankruptcy: the Wyoming Special-Purpose Depository Institution," she said.

- Coinbase shares are trading at $72 and are down 70% year to date.