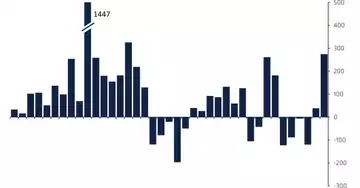

Digital asset funds saw their highest inflows since late 2021 last week as investors responded to the market panic caused by the Terra implosion.

Crypto funds saw inflows of $274 million in the week ending May 13 as the TerraUSD stablecoin (UST) - a cryptocurrency designed to trade at a fixed price of $1 - fell to a few cents, wiping out much of its $18 billion market cap and also rendering blockchain-owned token LUNA, once a top-10 cryptocurrency, virtually worthless.

James Butterfill, head of research at CoinShares, said this was a "strong signal that investors saw the recent UST stablecoin drop and the broad selloff that followed as a buying opportunity."

Bitcoin-focused funds were the clear winners, posting $299 million in weekly inflows, the highest since the last week of October 2021, with data suggesting investors were flocking to the relative safety of the largest digital asset, Butterfill said.

The investment surge came as bitcoin (BTC) fell to a low of $25,892 on Thursday on fears that Luna Foundation Guard, the organization tasked with supporting the UST in the event of a crisis, might sell its reserve of around 80,000 bitcoin in a panic. The bitcoin price mostly recovered from its losses late last week, changing hands at $30,000, a key psychological level.

Investors were polarized geographically, as North America-listed funds saw inflows of $312 million, while $32 million flowed out of European funds.

Bitcoin ETF

Purpose, the provider of the largest bitcoin exchange-traded fund listed in Canada, saw inflows of $284 million, dwarfing those of its competitors.

Non-bitcoin funds struggled with the market sell-off, with $26.7 million flowing out of funds managing Ether (ETH), while Solana (SOL)-focused vehicles saw outflows of $5 million.

Investors in blockchain-related stocks apparently panicked, as about $51 million left funds managing blockchain and crypto-focused stocks.

In contrast, multi-asset funds managing more than one cryptocurrency saw inflows of $8.6 million, suggesting that some investors preferred a diversified approach.