There has been a shift in thinking among major crypto investors, known as whales. Data shows that USD Coin (USDC) has become the stablecoin of choice on the Ethereum blockchain, rather than the larger Tether (USDT).

In cryptocurrencies, whales are the largest holders of cryptocurrencies - institutional investors, exchanges, individuals with a lot of money - who are able to move large amounts of tokens and influence market prices. Analysts closely monitor their activities to identify trends and predict large price movements.

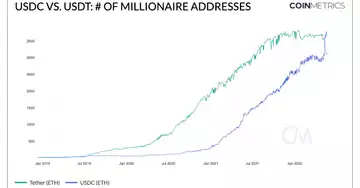

Data from CoinMetrics, a blockchain analytics firm, shows that wallet addresses on the Ethereum blockchain holding more than $1 million USDC have surpassed the number of wallets holding USDT, still the largest stablecoin by market cap.

"In the current market situation, many people see USDC as the safer, preferred stablecoin," Edward Moya, senior market analyst at trading platform Oanda, told CoinDesk.

USDC, the second largest stablecoin, has gained market share since the once $18 billion UST stablecoin collapsed and USDT's peg to the dollar wobbled.

CoinMetrics examined blockchain data since May 9, when UST lost its peg to the U.S. dollar. The company identified 147 Ethereum wallet addresses that increased their USDC balance by at least $1 million and decreased their USDT balance by at least $1 million. This included 23 addresses that added at least $10 million USDC and surrendered $10 million USDT. Many of these addresses are exchanges, custodians or decentralized financial protocols, the report added.

The report also said that USDC's lead over Tether's USDT in terms of so-called free float - the number of tokens held by investors - on the Ethereum blockchain reached an all-time high among all holder groups on Tuesday.

"This likely reflects the fact that only large holders generally have the privilege of redeeming USDT and minting new USDC to take advantage of arbitrage," Kyle Waters, an analyst at CoinMetrics, wrote in the report. "But it could also be the case that some large accounts are de-risking their holdings and turning to the perceived safety of USDC monthly certificates and full reserve backing."

Tether, the company behind USDT, reduced its commercial paper holdings by 17% in the first quarter to $20.1 billion from $24.2 billion, according to its latest quarterly report on assets backing the stablecoin. However, it also said $286 million of its assets were held in non-U.S. government bonds with maturities of less than 180 days.

USDT has faced a total of $10 billion in redemptions since the UST outage, shaking investor confidence in the stability of stablecoins in general. The redemptions dropped USDT's total circulating supply from $83 billion to $73 billion in 10 days. During the same period, USDC's supply increased from $48 billion to $53 billion.

Amid the turbulent events, as the value of UST fell to almost zero in a matter of days, USDT briefly lost its peg to the dollar. Although the price quickly recovered to $1, the wobble led to renewed uncertainty about which assets were supporting USDT's value.

Most decentralized financial transactions (DeFi) take place on the Ethereum blockchain, and USDC has been the stablecoin of choice in DeFi.

For example, DAI, the largest decentralized and over-collateralized stablecoin, holds USDC instead of USDT in its treasury. DAI, the currency of blockchain protocol MakerDAO, has a market cap of more than $6 billion and maintains its 1:1 exchange ratio to the U.S. dollar by accumulating many more crypto assets than the market value of all DAI tokens in circulation.