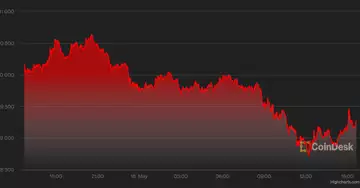

Bitcoin (BTC) fell back from a high of $30,654 on Wednesday, following losses in equities.

The cryptocurrency has been in a tight trading range in recent days, although volatility remains high. This could increase the risk of larger price swings or a potential breakdown in the charts.

At the moment, alternative cryptocurrencies (altcoins) continue to underperform Bitcoin, indicating a lower risk appetite among crypto traders. For example, Ether (ETH) is down 4% in the last 24 hours, while BTC is down 3% in the same period. Solana's SOL token dropped 7% and Decentraland's MANA token fell 10% on Wednesday.

Just launched! Please sign up for our daily Market Wrap newsletter, which explains what's happening in the crypto markets - and why.

The S&P 500 declined, while retail and technology stocks underperformed on Wednesday. The Chicago Board Options Exchange's CBOE Volatility Index (VIX), a popular measure of stock market volatility expectations based on S&P 500 index options, also rose on Wednesday, reversing a weeks-long downtrend.

Latest prices

●Bitcoin (BTC): $29,225, -2.67%

●Ether (ETH): $1,975, -3.28%

●S&P 500 daily close: $3,924, -4.03%

●Gold: $1,814 per troy ounce, -0.21%

●Ten-year Treasury yield daily close: 2.89%.

Bitcoin, ether, and gold prices are determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information on the CoinDesk indices can be found at coindesk.com/indices.

Volatility

ReturnsBitcoin's

short-term

realized volatility remains

elevated as the cryptocurrency struggles to maintain its $30,000 price level. And implied volatility (based on the market's expectation for its performance over a week) rose on Wednesday. This suggests that price action could remain choppy as traders react to macroeconomic risks and turbulence in the stablecoin market.

Options market data continues to show increased demand for puts over calls, indicating that traders are actively hedging the risk of a prolonged price decline.

According to Skew's data, the probability of BTC trading above $25,000 in June is currently 66%.

Sellers are in controlThe

chart

below

shows the ratio of buying and selling volume in the market for perpetual swaps on Bitcoin, a type of derivative similar to futures in traditional markets

.Values above 1 indicate optimistic sentiment, while values below 1 indicate negative sentiment. The 50-day moving average of the ratio of buying to selling volume has declined over the past two months, indicating continued selling pressure.

In addition, the ratio is still above previous lows, suggesting that the downward trend in the BTC price may continue until buyers return with greater conviction.

Altcoin Review

- Do Kwon plans to get Terra back on track: Terraform Labs founder Do Kwon announced an on-chain governance proposal Wednesday morning, despite minimal support from community members for the results of a preliminary online survey on a hard-fork plan. The new chain would eliminate the failed UST product entirely and instead focus on decentralized financial applications (DeFi) built on Terra. Read more here.

- Aave's decentralized social media platform arrives on Polygon: Lens Protocol opened Wednesday on the Polygon blockchain mainnet. It was developed by Aave Companies and allows developers to build their own decentralized social media networks where users fully own their data. The protocol was first announced in February, but now people can start minting their profiles. Read more here.

- NFT-focused venture fund: hackathon organizer DoraHacks has raised $20 million in a funding round led by FTX Ventures, the investment arm of crypto exchange FTX, and Liberty City Ventures. The capital will be used to drive the launch of the Dora Grant DAO, a decentralized grant community, and the Dora Infinite Fund, a venture fund focused on non-fungible tokens (NFTs). Read more here.

Relevant Insights

- Block sees Bitcoin as a disruptor for payment networks and expects self-storage to grow: chief financial officer Amrita Ahuja said the cryptocurrency could become a "global currency for the internet."

- Bitcoin miner Argo Blockchain has divested itself of its UST stake: The company said it was able to sell its minimal UST stake for around 93 cents per token before the price completely collapsed.

- SEC's Gensler Uses Crypto Oversight Needs as Argument for Higher Budget: Securities and Exchange Commission Chairman Gary Gensler told U.S. House of Representatives budget officials that he would like to do more to protect crypto investors.

- Binance in talks for regulatory approval in Germany, CEO says: Changpeng Zhao says the crypto exchange is recruiting compliance staff in the country.

- Swiss ETP issuer 21Shares dives into US market with 2 crypto index funds: The new funds are the first crypto products for US clients and will only be available to accredited investors.

- Argo Blockchain Q1 Net Income Plunges 90% to $2.1M: Bitcoin was priced in the $40,000 range for much of Q1, compared to nearly $60,000 in the same period last year.

- Nearly 5,505 ETH, or $10M of the $625M Ronin Exploit, is on the way: funds associated with the Ronin Exploiter address are making their way through Tornado Cash, blockchain data show.

Other MarketsMostdigital

assets in the CoinDesk 20 list ended the day lower

.Biggest winnersThere

are no winners in CoinDesk 20 today.Biggest losers

| Asset | Ticker | Earnings | DACS sector |

|---|---|---|---|

| Bitcoin Cash | BCH | -7.2% | Currency |

| Polygon | MATIC | -6.7% | Platform for smart contracts |

| Polkadot | DOT | -6.6% | Smart contracts platform |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), which was developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.