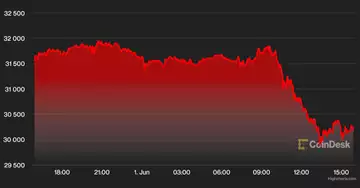

Bitcoin (BTC) drifted lower on Wednesday, erasing more than half of its rally in recent days. The cryptocurrency hit a low of around $29,880 during the New York trading session.

Most alternative cryptocurrencies (altcoins) fell along with BTC on Wednesday. For example, Solana's SOL token fell 10% over the past 24 hours, while BTC declined 4% over the same period. GALA and ADA fell by 7% on Wednesday.

Stock prices also fell on Wednesday, while gold and the 10-year government bond yield rose.

Just started! Please sign up for our daily Market Wrap newsletter, which explains what's happening in the crypto markets - and why.

Meanwhile, WAVES outperformed most cryptocurrencies, rising 21% in the last 24 hours. "We need to work on the algorithm," Sasha Ivanov said Wednesday on CoinDesk TV's "First Mover" show after the dollar was devalued several times.

Latest prices

●Bitcoin (BTC): $30,115, down 4.76%.

●Ether (ETH): $1,820, -5.83%

●S&P 500 daily close: 4.101, -0.75%

●Gold: $1,851 per troy ounce, +0.45%

●Ten-year Treasury yield daily close: 2.93%.

Bitcoin, ether, and gold prices are determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information on the CoinDesk indices can be found at coindesk.com/indices.

Losses Add UpMay was

a difficult month for both stocks and cryptocurrencies. It appears that macroeconomic uncertainty has kept some buyers on the sidelines, which gold and other commodities have benefited from so far this year.

In the last week of May, bitcoin and equities experienced a brief bounce that halted the overall downward trend in prices. Trading conditions have been volatile this year, but the overall theme remains low-risk.

In the crypto market, Bitcoin has declined less than other tokens in the CoinDesk 20 list over the past month. This indicates a lower risk appetite among crypto traders. Typically, Bitcoin falls less than altcoins in a down market due to its lower risk profile.

MATIC, SHIB, SOL, and AVAX are down more than 40% in the last month and have lost more than 60% year to date.

Lower Seasonal StrengthOn average

over the past nine years, Bitcoin has posted positive returns in June. However, in the following three months, the chances of a strong return decrease.

Bitcoin's negative return in May was outside the seasonal norm, meaning that current market conditions are different from the past nine years. For example, rising interest rates, high inflation and geopolitical risks have all weighed on speculative assets this year.

Altcoin Review

- Polygon Tightens KYC: Ethereum scaling system Polygon is increasing its know-your-customer (KYC) checks for potential investments and grants in India, a source told CoinDesk. Developers in India have recently spoken about the difficulty of obtaining funding or investment from Polygon. This comes amid the Indian government's increased scrutiny of digital assets and crypto companies. Read more here.

- Waves wants to optimize algorithm for its stablecoin: The algorithm that powers the Waves Protocol's Neutrino USD (USDN) stablecoin needs to be adjusted after two recent decouplings from the U.S. dollar, founder Sasha Ivanov said on CoinDesk TV. USDN has similarities in design to Terra's UST, which collapsed in May. The Waves (WAVES) token has gained 21% in the last 24 hours. Read more here.

- Optimism Airdrop Came Early: The highly anticipated Optimism Ethereum scaling system airdrop is officially scheduled to take place on Tuesday, but some users were already able to request OP tokens. The Optimism team was still testing the airdrop functionality. A team member told CoinDesk that rogue centralized changes came out before the official announcement. Read more here.

Relevant Insights

- US Charges Ex-OpenSea Exec with NFT Insider Trading: Justice Department officials say it's the first time they've pursued a charge of "insider trading" in digital assets.

- Crypto-banking rules are expected to be approved by the Basel Committee later this year: The group cited the recent turmoil to push its plans, which were previously opposed by major lenders such as JPMorgan Chase.

- Crypto Exchanges Should Lose Licenses for Money Laundering Violations, EU Regulators Say: The advice comes as lawmakers reach the final stages of the landmark crypto MiCA bill.

- Tech experts criticize crypto and blockchain in Washington: a letter from 26 technologists calls crypto risky, flawed and unproven.

- South Korean government to form digital assets committee in response to Terra collapse: The committee will establish criteria for listing coins, introduce investor protections, and monitor unfair trading.

- Zcash's NU5 upgrade goes live, improving privacy and removing "trusted setups." The privacy coin now allows transactions to be shielded by default, so users no longer have to choose to hide payment details on the blockchain.

- The Binance-backed deal to take Forbes public via a SPAC was canceled: Binance had invested $200 million in Forbes earlier this year.

- DeFi ledgers can help regulators oversee the sector, a BIS official says: A new BIS working paper argues for "embedded supervision" that can be built into seemingly uncontrollable decentralized financial systems.

- Gary Vaynerchuk files trademark for "Vayner3" NFT advisory arm: The venture could bolster Vaynerchuk's already influential presence in the NFT space.

Other MarketsMostdigital

assets in the CoinDesk 20 ended the day

down.Biggest winnersThere

are no winners in CoinDesk 20 today.Biggest losers

.| Asset | Ticker | Earnings | DACS Sector |

|---|---|---|---|

| Solana | SOL | -9.4% | Smart contracts platform |

| Polygon | MATIC | -7.0% | Platform for smart contracts |

| Cardano | ADA | -7.0% | Smart contracts platform |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), which was developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.