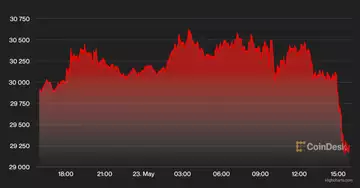

Bitcoin (BTC) failed to hold above $30,000 on Monday as some buyers remained on the sidelines. The cryptocurrency fell later in the New York trading session, indicating a loss of short-term momentum.

Alternative cryptocurrencies (altcoins) were mixed on Monday. For example, Fantom's FTM token rose as much as 16% over the past 24 hours, while Decentraland's MANA token fell 3% over the same period. The choppy trading conditions suggest some caution among crypto traders, especially in the last week.

Currently, bitcoin is in a tight trading range and there is a risk of a breakdown. "From a trading standpoint, an upside breakout could provide an opportunity for fading, with a target of a breakout to new lows for the year," Michael Boutros, an analyst at DailyFX, wrote in an email to CoinDesk. Should a breakout occur, Boutros has a downside target of $19,666 for BTC.

Just launched! Please sign up for our daily Market Wrap newsletter, where we explain what's happening in the crypto markets - and why.

Still, some analysts have noted signs of capitulation that could support a price rise. Sean Farrell, vice president of digital assets at FundStrat, noted that recent selling pressure has come from spot market traders rather than futures traders. This suggests that a large unwind of leveraged positions is unlikely, similar to previous sell-offs.

Instead, BTC's downtrend may be gradual, especially if macroeconomic headwinds continue. Despite signs of capitulation and waning investor sentiment, the current macroeconomic environment is still a significant headwind for cryptoasset prices," Farrell wrote in a research note.

Latest prices

●Bitcoin (BTC): $29.148, -2.69%

Ether (ETH): $1,987, -1.22%

●S&P 500 daily close: $3,974, +1.86%

●Gold: $1,853 per troy ounce, +0.60%

●Ten-year Treasury yield daily close: 2.86%.

Bitcoin, ether, and gold prices will be determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information on CoinDesk indices can be found at coindesk.com/indices.

Relief from the U.S. Dollar?

The U.S. dollar index (DXY) is down about 3% from its recent high reached on May 13, which could provide support for BTC due to its negative correlation with the dollar.

Previous highs in the DXY coincided with lows in the BTC price. And the U.S. dollar's rise last year coincided with a failed breakout of BTC at $69,000, leading to a 60 percent drop in the cryptocurrency's price.

However, the performance of the index is not a perfect signal for BTC, especially because of macroeconomic uncertainty.

The chart below shows the 90-day correlation between BTC and the US dollar, which is mostly negative. Nevertheless, the correlation could increase during market turmoil, similar to what happened in 2018 and 2020.

Altcoin Summary

- Goblintown is having its moment: the non-fungible tokens of "Goblintown" (NFT) generated over $7 million in sales volume this weekend, fueled by rumors of a larger team that could be behind the scenes. The goblin-themed digital artwork is a nod to a popular joke in crypto circles that the market downturn is "down to Goblin Town." The success of the project may indicate that the NFT market still has some juice left in it, despite the overall decline in sales volume. Read more here.

- Terra's systemic risk in DeFi: Investment banking giant Goldman Sachs (GS) said in a report that systemic risk is growing as decentralized financial applications (DeFi) become more interconnected. One example is the collapse of UST stablecoin, which spread to Lido, one of the largest liquid staking pools, and its Staked Ether holdings. Staked Ether (stETH) traded at a 4.5% discount to ETH on the spot market as users converted stETH at Lido into Bonded Ether (bETH) on the Terra blockchain and earned a return on Anchor, Terra's largest yield-farming protocol. Read more here.

- Filecoin flies into space: Defense contractor Lockheed Martin (LMT) and the Filecoin Foundation could soon make an open-source blockchain network accessible in space, operating a data storage node on a satellite. Filecoin is a decentralized network for data storage and distribution. Currently, satellites interact mainly with servers on Earth. A node in space can help send instructions faster to distant objects orbiting the moon or Mars. Filecoin's native token, FIL, has risen nearly 8% in the last 24 hours. Read more here.

Relevant Insights

- Listen 🎧: What's next for the crypto market? Plus, the CoinDesk Markets Daily podcast takes a look at the recent explosion at a crypto mining farm in New York.

- Korean police seek to freeze Luna Foundation Guard assets: Seoul police are trying to ban the organization from withdrawing suspected misappropriated funds.

- Fed Survey: 12% of U.S. Adults Held Crypto in 2021: It's the first appearance of crypto in the central bank's "Economic Well-Being of U.S. Households" survey.

- GameStop introduces crypto and NFT wallet, shares jump 3%: A beta version of the self-managed Ethereum wallet is now available for download on GameStop's (GME) website.

- ICO-funded project Sparkster converts $22M in Ether to USDC after 3 years, with no product: Sparkster promised investors a "no-code" software creation platform with $30 million in funds raised from investors in 2018.

- Japanese bank Sumitomo Mitsui Trust plans to launch a custodian for digital assets: The bank's pivot to digital assets comes amid a global shift in banking toward cryptocurrencies.

- BNP Paribas joins JPM's Onyx blockchain network for fixed income trading: The French bank will use the Onyx network for short-term trading in fixed income securities.

- Regulators pay attention to UST: The collapse of terraUSD (UST) is the Libra moment for algorithmic stablecoins.

Other markets.

Most digital assets in the CoinDesk 20 ended the day lower.

Biggest gains

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ethereum Classic | ETC | +5.9% | Smart contracts platform |

| Polkadot | DOT | +2.0% | Platform for smart contracts |

| Filecoin | FIL | +1.1% | Data processing |

Biggest losers

| Asset | Ticker | Earnings | DACS Sector |

|---|---|---|---|

| Cardano | ADA | -3.1% | Smart contracts platform |

| Litecoin | LTC | -2.9% | Currency |

| Bitcoin | BTC | -2.8% | Currency |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.