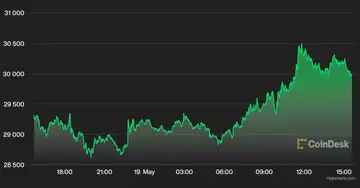

Bitcoin (BTC) briefly rose above $30,000 on Tuesday, extending its week-long trading range to the upside.

Most cryptocurrencies appear to be stabilizing along with stocks, indicating a pause in bearish sentiment among traders. Some technical indicators for BTC and the S&P 500 remain in oversold territory, although the long-term charts suggest limited upside from here.

Some alternative cryptocurrencies (altcoins) rallied on Tuesday, albeit within a six-month downtrend. For example, Solana's SOL token rose as much as 2% over the past 24 hours, while BTC's price rose 3% over the same period. Still, SOL has fallen 50% in the last month, compared to a 35% drop in Ether (ETH) and a 27% drop in BTC.

Just launched! Please sign up for our daily Market Wrap newsletter, which explains what's happening in the crypto markets - and why.

On the regulatory front, Alessio Evangelista, Associate Director for Enforcement at the U.S. Treasury Department's Financial Crimes Enforcement Network, spoke at a conference on Thursday where he called on the crypto industry to proactively blacklist "problematic" wallets. In addition, finance ministers from the Group of Seven (G-7) major developed economies are preparing to call for faster global crypto regulation, Reuters reported.

In traditional markets, stocks were mixed, while gold, a traditional safe haven, traded a tick higher. Meanwhile, the U.S. dollar weakened after hitting its highest level in four years last week.

Latest prices

●Bitcoin (BTC): $29,998, up 2.56%.

●Ether (ETH): $1,995, +1.20%

●S&P 500 daily close: $3,901, -0.58%

●Gold: $1,842 per troy ounce, +1.42%

●Ten-year Treasury yield daily close: 2.85%.

Bitcoin, ether, and gold prices are determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information on the CoinDesk indices can be found at coindesk.com/indices.

Bitcoin's relative strength

Bitcoin has outperformed other cryptocurrencies in recent months, indicating a lower risk appetite among traders.

Typically, Bitcoin falls less than altcoins in a down market because its risk profile is lower compared to smaller tokens. In a rising market, the opposite is true.

Only 15% of the top 50 altcoins have outperformed Bitcoin over the past 90 days, according to the Blockchain Center. That suggests risk aversion.

However, over time, a sustained rally in altcoins could be a sign of a risk-on environment, similar to what happened in January and August of last year.

The chart below shows the bitcoin dominance ratio, which is the market capitalization of BTC relative to the total crypto market capitalization. The ratio broke out above a short-term downtrend last week and continues to rise. A sustained value above 50% would signal a risk environment similar to 2018.

Altcoin Review

- Hashed wallet suffers $3.5 billion in damage after Terra's LUNA collapses: Delphi Digital says LUNA tokens accounted for 13% of its assets under management at their peak, while Hashed, an early-stage venture firm, appears to have lost more than $3.5 billion. This is the latest consequence of the loss of confidence in Terra's UST stablecoin. In addition, local media in South Korea report that more than 200,000 investors in the country hold tokens from Terra. The newly elected president of South Korea, Yoon Suk-yeol, is a proponent of cryptocurrencies and has promised a regulatory framework for the asset class. Read more here.

- Tether has reduced its commercial paper reserve by 17%: The reduction occurred in the first quarter, according to its latest certification report. The commercial paper reduction continued with another 20% reduction since April 1, which will be reflected in the second quarter report, Tether announced Thursday. As of June 30, 2021, commercial paper and certificates of deposit totaled $30.8 billion, representing 49% of Tether's assets. Read more here.

- Magic Eden surpasses OpenSea in daily trading volume: Solana's non-fungible token (NFT) market is starting to take hold. Daily transactions on the ecosystem's leading marketplace, Magic Eden, now surpass OpenSea, the Ethereum blockchain counterpart. According to weekly data from DappRadar, Magic Eden has seen about 275,000 daily transactions, which include purchases, bids and listings, compared to OpenSea's 50,000. Read more here.

Relevant Insights

- Panama's president considers vetoing crypto-regulatory legislation: the bill passed by a 40-0 vote during a plenary session of the Legislative Assembly on April 28.

- A U.S. Treasury official warns the crypto industry to proactively sanction "problematic" wallets: FinCEN Associate Director Alessio Evangelista said crypto service providers should not wait for the government to designate a wallet if it is being used for illegal activity.

- Fed Vice Chair Pick and Ex-Ripple Advisor Tells Senators Crypto Needs Regulation: Former U.S. Treasury official Michael Barr fielded questions about crypto during his Senate nomination hearing.

- MicroStrategy's new CFO says bitcoin strategy remains unchanged amid market decline: Report: Andrew Kang spoke to The Wall Street Journal on Wednesday about MicroStrategy's bitcoin strategy.

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest gains

| Asset | Ticker | Returns | DACS sector |

|---|---|---|---|

| Litecoin | LTC | +3.9% | Currency |

| Bitcoin | BTC | +2.8% | Currency |

| Internet computer | ICP | +2.3% | Data processing |

Biggest losers

| Asset | Ticker | Earnings | DACS Sector |

|---|---|---|---|

| Algorand | ALGO | -4.4% | Smart contracts platform |

| Stellar | XLM | -3.0% | Platform for smart contracts |

| Polygon | MATIC | -1.6% | Smart contract platform |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

UPDATE (May 18, 20:45 UTC): Adds information on US equity markets and their declines.