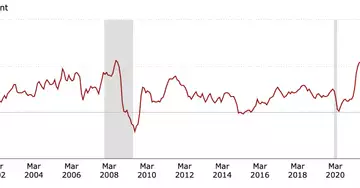

After months of rising inflation, a new U.S. government report this week may finally show a slowdown in price increases. But don't be fooled: That doesn't necessarily mean upward pressure is easing.

The U.S. Department of Labor will release its Consumer Price Index (CPI) report for April on Wednesday.

Bitcoin (BTC) traders will be watching this closely, as the largest cryptocurrency by market cap has been heavily influenced by macroeconomic indicators of late. In particular, the prospect of aggressive monetary tightening by the U.S. Federal Reserve - in response to the highest inflation rate in four decades - helped push bitcoin down to a 10-month low around $30,000 this week.

Forecasters expect headline inflation to have risen 8.1% year-on-year in April, according to data from Factset, which would be lower than the 8.5% reported for March.

However, comparing the year-over-year change could be misleading, as the consumer price index took a big jump in April 2021. That data point could skew interpretations of this week's report.

"There is the problem of year-over-year comparisons because there was a big jump in inflation last spring," said John E. Silvia, former chief economist at Wells Fargo and founder of Dynamic Economic Strategy.

Eric Winograd, senior vice president and director of developed market economic research at AllianceBernstein, agrees. "Year-over-year numbers are almost always going to be down, no matter what. That's not particularly meaningful because it doesn't tell us what prices are really like. They tell us what prices were like a year ago," he said.

Energy prices - particularly gasoline prices, which accounted for more than half of the overall monthly price increase in March - were more stable in April, which is one reason economists expect overall inflation to slow.

Core inflation

Instead, traders will be watching core inflation much more closely, which is expected to have risen 0.4% from March, indicating higher month-on-month inflation. Core inflation excludes the impact of food and energy prices, which tend to fluctuate more than other goods and services.

"It's really the core inflation numbers that are important," Winograd said. "There is a widespread perception that supply and demand in the economy are out of balance, and that is likely to keep core inflation relatively high.

"Problems with rents may show up, so the core inflation index may not have peaked yet," Silvia said.

Federal Reserve Chairman Jerome Powell said the main drivers of inflation right now are supply chain disruptions and consumer demand, but there is a new concern that wage pressures may be emerging. Last week, the Labor Department reported that the U.S. labor market remained tight in April, which tends to push wages higher.

The U.S. Labor Cost Index also showed that labor costs rose last month at the fastest pace in two decades.

As for how Wednesday's report will affect Federal Reserve officials, their minds may already be made up. Powell said last week that a 75 basis point (0.75 percentage point) rate hike is not being considered and that 50 basis points should be on the table for the next few meetings.

"It would take something very dramatic to happen for them to change that path," Winograd said.