DAVOS, Switzerland - Thailand has been working on a retail central bank digital currency (CBDC). An initial pilot was planned for the second quarter of 2022, but has been postponed until the fourth quarter of this year.

The pilot, or trial, of the CBDC, which is intended for consumer use, will test deposits, withdrawals and transfers. A central bank official said last August that CBDC will be tested for retail customers as an alternative payment method for "cash-like activities on a limited scale."

Earlier this year, Thailand also revealed plans to regulate cryptocurrencies as a payment method, announcing in March that it would ban the use of cryptocurrencies in payments.

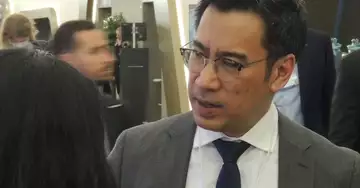

CoinDesk spoke with Central Bank of Thailand Governor Sethaput Suthiwartnarueput about the bank's plans for a retail CBDC and why the pilot project was postponed following a panel titled "Central Bank Digital Currencies" last week at the World Economic Forum Annual Meeting in Davos, Switzerland.

The following text has been slightly shortened for brevity and clarity.

CoinDesk: The Thai CBDC pilot project was scheduled for the second quarter of 2022, but has been delayed. What is the latest status of the project?

Suthiwartnarueput: It has just been pushed back a bit. That's the usual thing when you're trying to make an adjustment. We've been consulting more extensively with stakeholders to make sure that we get the design right for the pilot. So yes, that would be in the fourth quarter of this year if we could get it out. It will probably take about six months. But it's a pilot project on a limited scale. We just want to make sure that we can take it from start to finish and bring in the stakeholders that we want, both banks and non-banks. It's questionable how quickly a retail CBDC can move to production scale. But when it does, it will justify an infrastructure rather than a product, because central banks are not good at developing products that resonate with customers. So we see it as creating the infrastructure on which the private sector can innovate and making sure that the platform on which they innovate is controllable. I think it was the governor of the French central bank who mentioned that the private sector is much better at innovation and customer orientation than the central banks. I think a retail CBDC will eventually coexist with other things. Yes, it will probably replace cash. But not the other things that are still out there, including private things. That's kind of how we see it. The reason I mentioned non-banks is because we think we need new players in this space and as part of this pilot.

When central banks start to look at retail CBDCs, they suddenly realize that there are a lot of aspects they need to think about, but we don't really hear a lot of details about some of these challenges they have faced. It's usually vague terms like "design" or "underlying technology," but what does that really mean for consumers?

Again, we come back to the point that was made in the panel discussion, which is that we need to be clear about what problem we're trying to solve and think about the benefits associated with it. The existing system works pretty well, if we have a fast payment system, it works very well. So the additional benefits that would come from using a CBDC for retail payments are not immediately known. So it's important that we get it right rather than get it out quickly. But if you ask me if we're still pursuing it, researching it, and making sure we're ready, the short answer is yes. And why? Because even though fast payment systems give us a lot of low-hanging fruit that we can leverage, we recognize that there are limits from an innovation standpoint. CBDCs and retail CBDCs offer more potential for the private sector to get involved and innovate. You can't give a fast payment system programmability. It wouldn't work. There are a lot of potential issues, both in terms of benefits and risks and exploring unintended consequences. A retail CBDC is not insignificant, and that's why we are proceeding steadily.

What does it mean for Thailand if the private sector builds on a retail CBDC? Could you see commercial banks issuing digital currency on behalf of the central bank?

You will find out during the upcoming pilot.