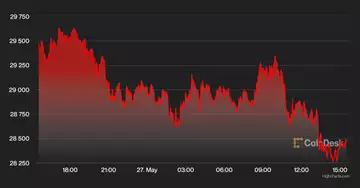

Bitcoin (BTC) and other cryptocurrencies traded lower on Friday despite another uptick in stocks.

Crypto traders are still in risk-off mode after nearly nine straight weeks of negative returns. BTC is down 27% this month, although it has recovered 10% from its recent low of $25,840 on May 12.

The cryptocurrency is still down 40% so far this year, compared to a 13% drop in the S&P 500 and a 22% drop in the Nasdaq 100 over the same period. So far, it's been a tough year for all speculative assets.

Just started! Please sign up for our daily Market Wrap newsletter, where we explain what's happening in the crypto markets - and why.

In the short term, however, prices could stabilize. "There has been massive short selling in recent weeks, which could lead to a short squeeze in the coming weeks. The month-end shifts could also help," David Duong, head of institutional research at Coinbase, wrote in a newsletter Friday.

On the macro front, MRB Partners, a global investment research firm, expects equity markets to rally if global growth conditions prove resilient. The firm expects interest rate expectations and bond yields to remain quiet for a while, which is likely as inflation temporarily declines, first in the U.S. and then elsewhere. Central banks, in turn, are likely to briefly cool their newfound hawkishness," MRB wrote in an email.

The short-term rise in equities could be a tailwind for cryptocurrencies, assuming the high correlation between the two assets remains intact. In contrast, the decline in cryptocurrencies could be a sign that the uptrend in equities is limited as low-risk sentiment prevails.

Latest prices

●Bitcoin (BTC): $28,940, -1.83%.

●Ether (ETH): $1,760, -4.35%

●S&P 500 daily close: 4.158, +2.47%

●Gold: $1,857 per troy ounce, +0.51%

●Ten-year Treasury yield daily close: 2.74%.

Bitcoin, ether, and gold prices are determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information on the CoinDesk indices can be found at coindesk.com/indices.

Volatility is easing, for now

The chart below shows the recent decline in BTC's short-term implied volatility. This suggests that options traders expected price volatility to stabilize after BTC briefly fell towards $28,000 on Thursday.

For now, Bitcoin remains in a tight range as volatility has returned to normal levels. However, on a six-month view (second chart), implied volatility remains elevated and demand for puts (downside protection) has been stronger than calls.

Altcoin Review

- DOGE briefly jumped on SpaceX tweet: Tesla (TSLA) CEO Elon Musk tweeted Friday morning ET that goods for SpaceX, his space exploration startup, can soon be purchased with Dogecoin, just as Tesla goods can. DOGE's share price jumped as much as 10% to nearly 9 cents immediately after the tweet, before giving up most of those gains over the course of the New York trading day. Read more here.

- Tether's dollar-linked stablecoin expansion via Polygon: Tether launched its USDT token on Polygon, an Ethereum scaling platform, meaning the largest stablecoin by market cap is now available on more than 11 blockchains, the company said. The addition of USDT, which is pegged 1:1 to the dollar and has a market cap of more than $73 billion, will help support Polygon's decentralized financial ecosystem (DeFi). Read more here.

- Launch of new Terra blockchain expected Saturday: Terra's new blockchain will launch Saturday, followed by an airdrop of new LUNA tokens to users as part of a broader plan to revitalize the ecosystem, developers confirmed Friday. "The community has been working around the clock to coordinate the launch of the new chain," Terra developers said in a tweet Friday morning. "Subject to possible changes, we expect Terra to go live at approximately 06:00 UTC on May 28, 2022." Read more here.

Relevant Insights

- Cardano's Hoskinson: Luna collapse shows need to go slow in crypto: "If you move too fast ... everyone loses their money," says Charles Hoskinson, who will speak at Consensus 2022 next month.

- U.K. crypto hedge fund weathering market storm with arbitrage strategy: Nickel Digital Asset Management's arbitrage fund is down only about 0.6% this year, compared to Bitcoin's roughly 40% drop and Nasdaq's 24% decline.

- The crypto community says the UK FCA is finally starting to listen: The UK regulator's first CryptoSprint focused on digital asset disclosure, custody and other regulatory obligations.

- Ether is responsible for nearly half of the $520 million in liquidations, though on-chain data is weak: Traders of Ether futures saw liquidations nearly double those of Bitcoin in an unusual move.

- Leading Latin American crypto exchange Bitso lays off 80 employees: the company, which had more than 700 employees before the layoffs, has four million users in the region.

Other markets

Most digital assets in the CoinDesk 20 list ended the day lower.

Biggest gains

| Asset | Ticker | Returns | DACS sector |

|---|---|---|---|

| Dogecoin | DOGE | +1.9% | Currency |

| Ethereum Classic | ETC | +1.2% | Smart contracts platform |

| Polkadot | DOT | +0.6% | Platform for smart contracts |

Biggest losers

| Asset | Ticker | Earnings | DACS Sector |

|---|---|---|---|

| Solana | SOL | -5.2% | Smart contracts platform |

| Cardano | ADA | -5.1% | Platform for smart contracts |

| Filecoin | FIL | -5.0% | Data Processing |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.